Award-winning PDF software

Form 8288 Sterling Heights Michigan: What You Should Know

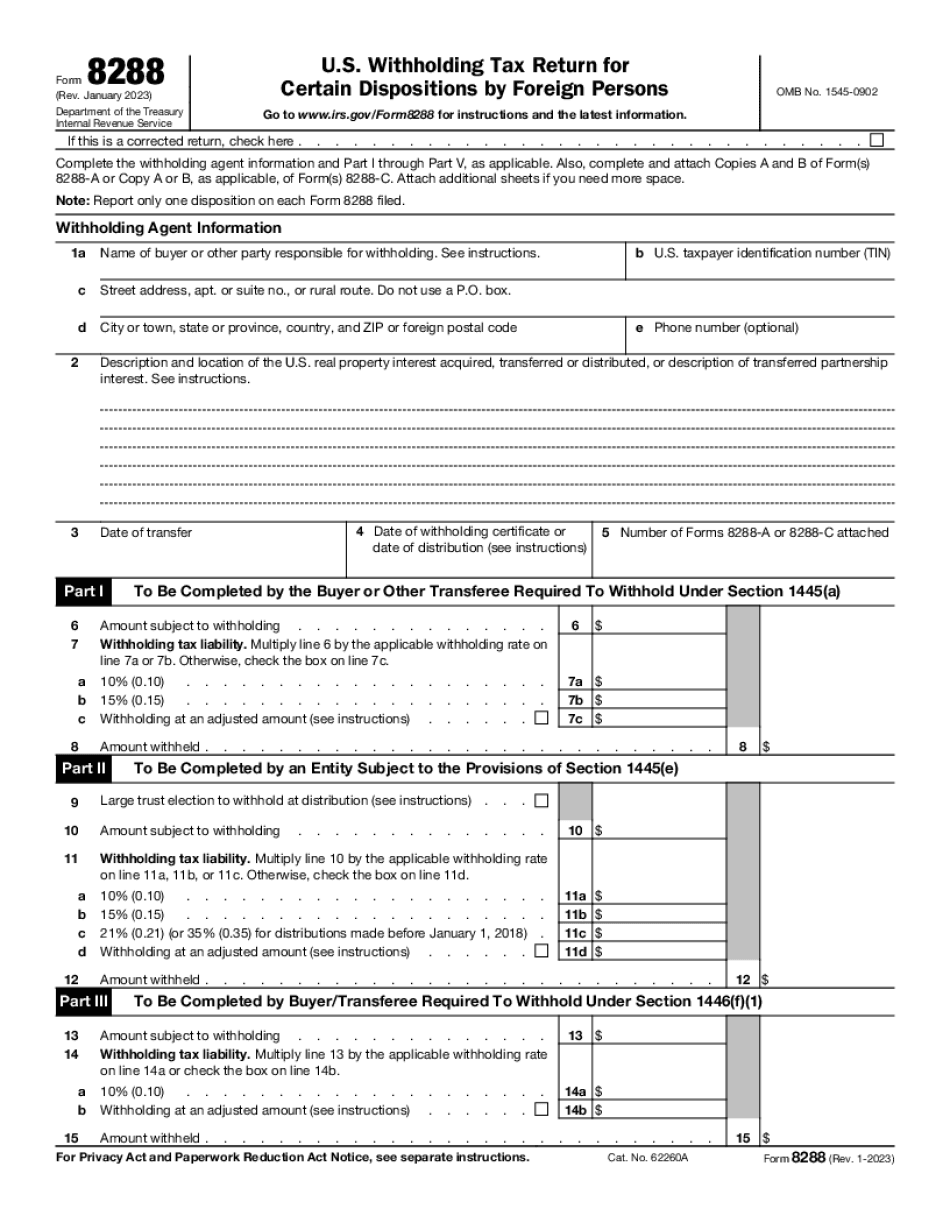

In most cases, the return is filed electronically. A request for comment (request for clarification) must be filed by the 10th day of each month, but not later than February 1 for the previous month. Oct 2025 — Form 8288 has been approved for use with the electronic filing of tax returns by taxpayers in most parts of the country. If you file a return electronically, you may request a copy of your Form 8288. Oct 2025 — The IRS is working to expand the Form 8288 to include certain real property interests in the United States. If a transferor claims any real property interests in the U.S., Form 8288 must be attached to the transferor's income tax return. Feb 21, 2018 — The IRS has revised Form 8288-A to clarify the amount to report as adjusted gross income (AGI). The updated version states that the AGI for a disqualified foreign person who qualifies for a credit of 500 for making a timely filing of their income tax return for the following year is 500,000 (2016). Previously, the AGI for a disqualified foreign person who qualifies for a credit of 500 is 500,000 (2016). The IRS has also clarified to the IRS-Form 8288 that the reporting of AGI is an exception to the 500,000 limitation for returns, filings, and payees with no U.S. connections, and to the AGI limitation for certain types of dispositions of controlled foreign corporation interests. Form 8288-Q Form 8288-Q is used to report the return of a taxpayer making a distribution from the U.S. in connection with a termination of a qualified retirement plan or pension, annuity, retirement plan, or similar arrangement. In most cases, this activity involves a sale, exchange, or other disposition of property that is in excess of the fair market value of the property on the date of the distribution or the date of a sale, exchange, or other disposition of the property by the qualifying retirement plan, pension, or other arrangement, to a U.S. person, or a U.S. person and a qualifying beneficiary. The distribution is recognized at the time of disposition so long as you timely file your return for any taxable year involving the disposition. The amount of your tax withholding has no effect on the distribution. See IRS.com for details.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288 Sterling Heights Michigan, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8288 Sterling Heights Michigan?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288 Sterling Heights Michigan aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288 Sterling Heights Michigan from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.