Award-winning PDF software

Form 8288 online Provo Utah: What You Should Know

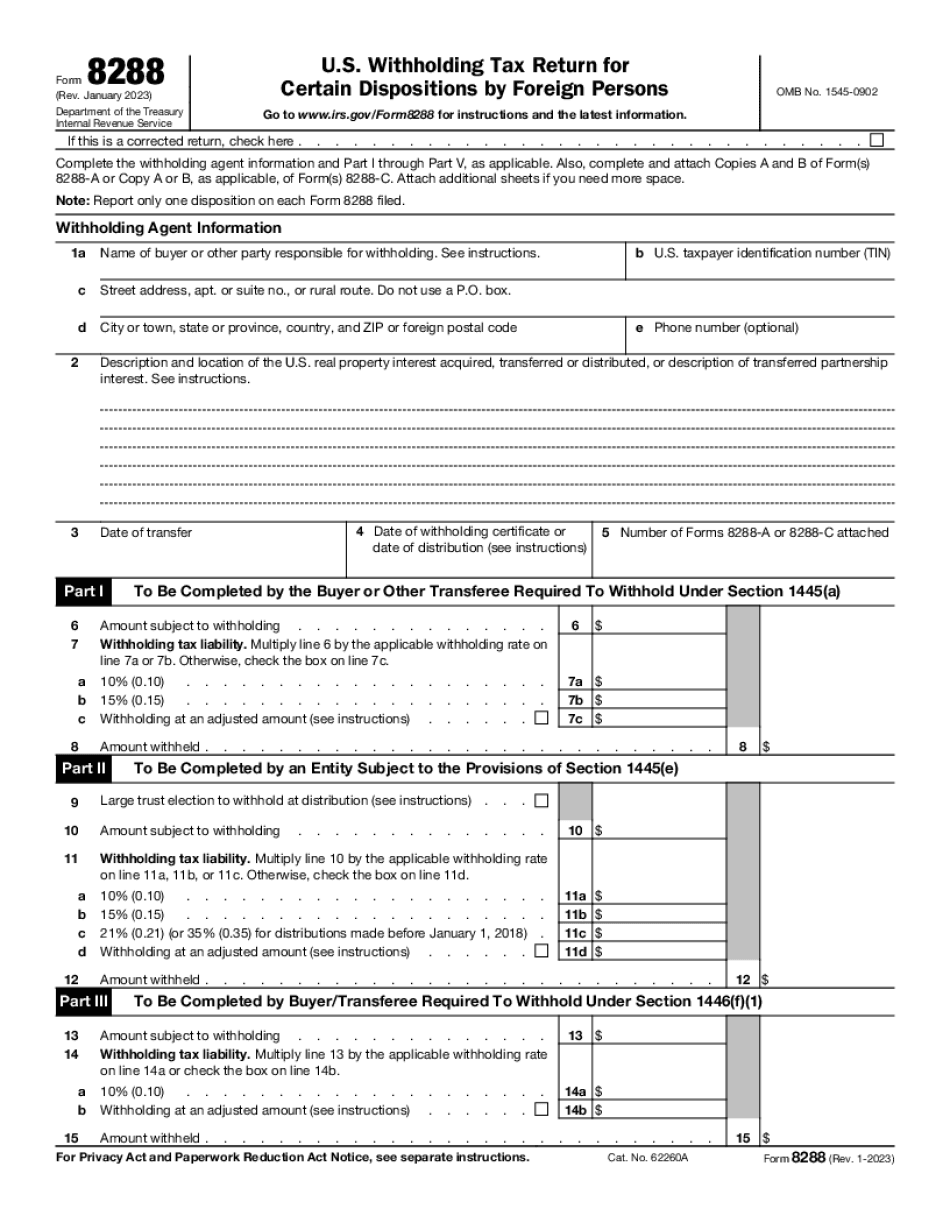

IRS.gov for individuals and corporations. You have two options at this point for a return filed on Form 8288, as indicated in the example. Use the form to correct or amend a Form 8288 for the year in question, including Form 8288-A. Form 8288-A can also be used to correct errors and over payments you made on previously-filed income tax return. Correct a Form 8288-A. Use the Form 8288-A, “Amended Form 8288” to correct, amend, or supplement information on a Form 8288, Form 8289, or Form 8288A. This is a new application process that uses the online, online-only procedures of the online tax processing system. For information on how to use Form 8288 and associated tax return preparation tools, see IRS Publication 505 to determine if using the Internet is right for you. To order Form 8289, see the online form. This form has a page dedicated to the form. Form 8288 is at the bottom on the page. Below is a general format, shown in the image below. If the return is corrected or amended in whole or in part using the Online Tax Return Assistance Tool (THAT), you will need to complete one Form 8288-B, Application for the Employer's ETC and the Employer is not Required to Comply With the IRS Reporting Requirements (Exceptions Apply). If the return is not corrected or amended, the tax return was actually filed as a regular tax return with no adjustments. This is shown in the image below. You should use Form 8288 for the most recent taxes paid on or before the last day of the tax year. You should also use Form 8288-B if you made any payments to the tax filer, made any adjustments to your Form 1040, 1040A, or 1040EZ, changed a liability to zero, and made any deductions, exclusions, or limitations for which the return was prepared. For more information on Forms 8288, U.S. Withholding Tax Return for — IRS, see Publication 505, Tax Withholding. You can also search the IRS publication using the keyword “Form 8288” in the Additional Tax Resources link at the bottom of the IRS website. A couple of years ago, it was possible to upload a photo of your Form 8288, with an image caption if your photo was not your own, into the U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288 online Provo Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8288 online Provo Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288 online Provo Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288 online Provo Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.