Award-winning PDF software

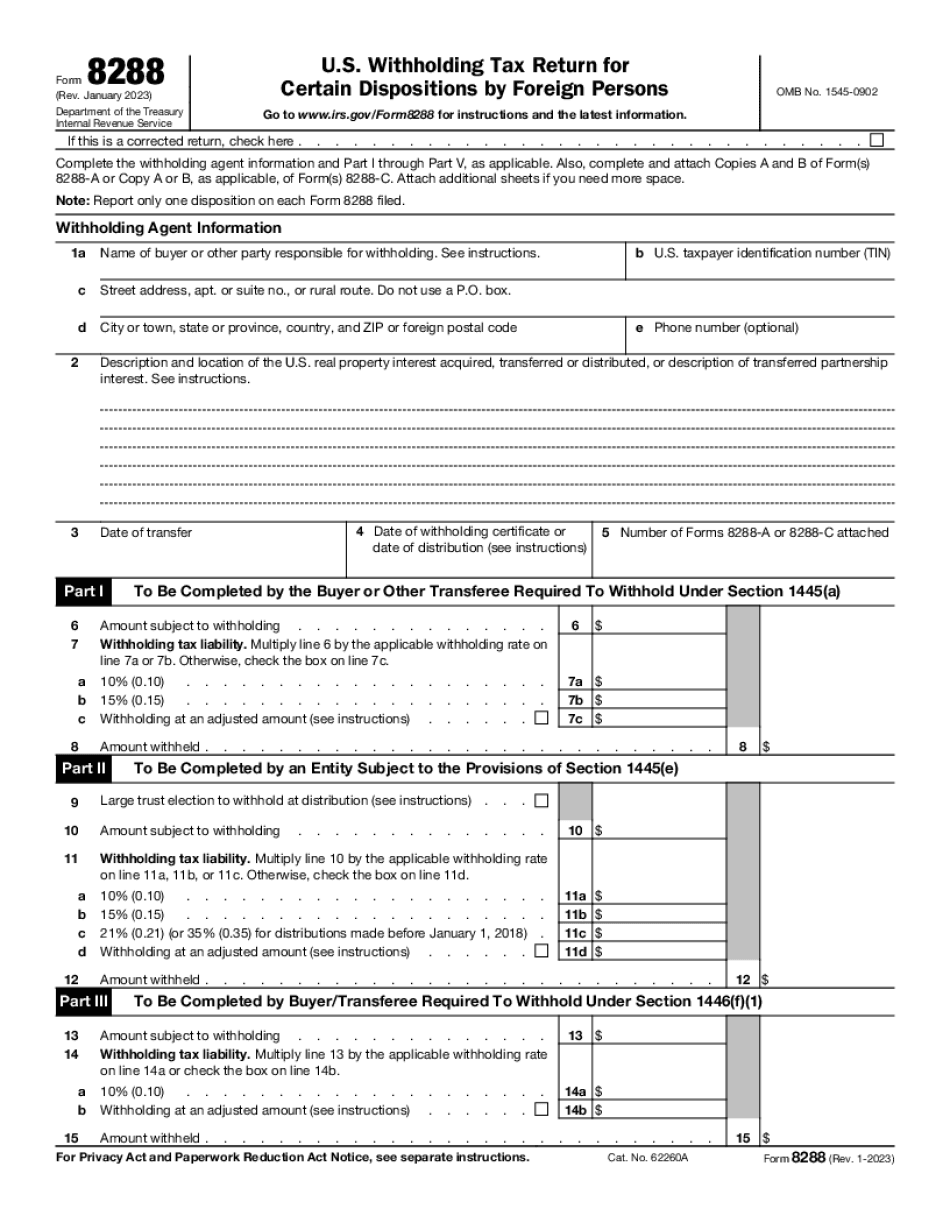

NY Form 8288: What You Should Know

See our IRS guide on the OIC for more information. Section 1) Description of the debt Section 2) The amount owed Section 3) The source and nature of the debt, including the amount and source of any proceeds from sales of the debt property. Section 4) The circumstances of the debt. Section 5) An explanation of any proposed collection actions. Notice of collection procedures Section 433-B(k) provides general notice to creditors of the existence of any collection action.” The statement sets forth notice requirements to creditors which may be used in collection proceedings where the federal government is a party. The notice must contain the following information, as well as the creditor's right to contest the action and to seek such further relief as the court may determine. Notice requirements Section 433-B(k) provides general notice to creditors of the existence of any collection action” which may involve the collection of a debt by any person. Section 433-B(k) must consist of a statement on a form which is clearly legible, and provides the following required information to a creditor or other person that may initiate a collection proceeding: Section 433-B(k) provides notice requirements to a creditor or other person that may initiate a collection proceeding Notice must be in writing. Notice must be given (and an opportunity to dispute) within the time set forth in Section 433-B(k). Notice cannot, however, be sent by other than certified mail, or by any means which is undeliverable to the creditor, if the person who is to receive the notice is less than 65 years of age. The notice must be sent to or delivered to the creditor or other person, if there is no person liable for the debt. Failure of the creditor to receive the notice within the time period specified in Section 433-B(k) may result in the filing of the claim for a deficiency judgment for the amount of the delinquent debt, or may result in the imposition of an administrative collection lien. Creditors are not entitled to receive the notice at the office of the Federal tax collector. Section 433-B(l) of the IRS code limits the notification requirement to the creditor's principal place of business unless another place is indicated. (If there are multiple offices, the notice must be given only to the office of the place where records are maintained.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete NY Form 8288, keep away from glitches and furnish it inside a timely method:

How to complete a NY Form 8288?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your NY Form 8288 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your NY Form 8288 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.