Award-winning PDF software

Form 8288 Florida Hillsborough: What You Should Know

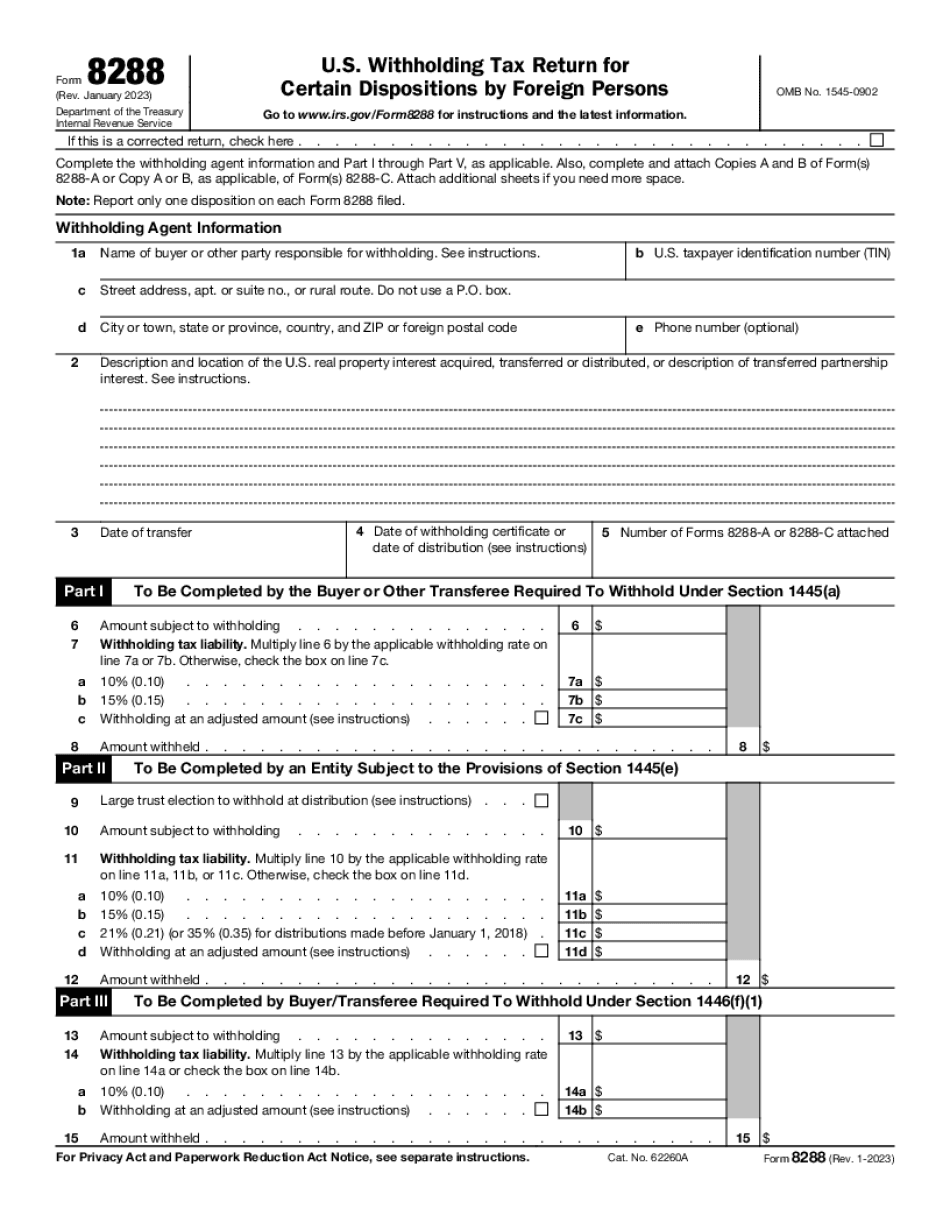

Effective January 1, 2010, House Bill 776 establishes a statewide computer-based process, and a uniform statewide procedure, by which licensees, recipients, and registrants may notify the State of a change of name and/or address. If you discover a change of name in your case file that you did not submit to the Department of Agriculture and Consumer Services, you might wish to consider calling or writing the Department of Agriculture and Consumer Services at the address given below. You may download and mail your notice or change of address. Alternatively, you may fax this form. Your notification and/or change of address must be completed on the same page for accuracy. Please note, if you have already mailed your change of name or address, your notice or change of address must be mailed to FL Agriculture and Consumer Services, Office of the Secretary of State, 3500 SW 23rd Street, Tallahassee, Florida 32399, by January 11, 2009. Please see the Department of Agriculture and Consumer Services website for more information. U.S. Withholding Tax Return Form 8288 — For Florida Sales Taxes, Florida Use Tax, and Federal Excise Tax Return Withheld If you are planning to use (receive) a property, you will receive a document called Form 8288 that you must complete. It is the original return, but this form does allow you to modify your payment to the IRS. You still have to pay the taxes if the property tax is due, and this form will give you a way to do that. Your form 8288 can be used by any person or foreign entity which is required by the State of Florida (or its designee) to return a Florida sales/use tax or federal excise taxes to the State. Please note, the Florida Commissioner of Revenue may impose additional requirements and penalties beyond what is described in this form. What's New The County of Hillsborough has decided to amend the 8288 form by adding a section called “Special Exemptions” (under Part IV) to specifically exempt certain types of property. These are tax-exempt items that are not subject to sales tax, state use tax or federal excise tax. This change makes it so that non-exempt properties that would previously have been required to pay sales tax cannot be exempt for the purpose of Form 8288.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288 Florida Hillsborough, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8288 Florida Hillsborough?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288 Florida Hillsborough aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288 Florida Hillsborough from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.