Award-winning PDF software

North Las Vegas Nevada Form 8288: What You Should Know

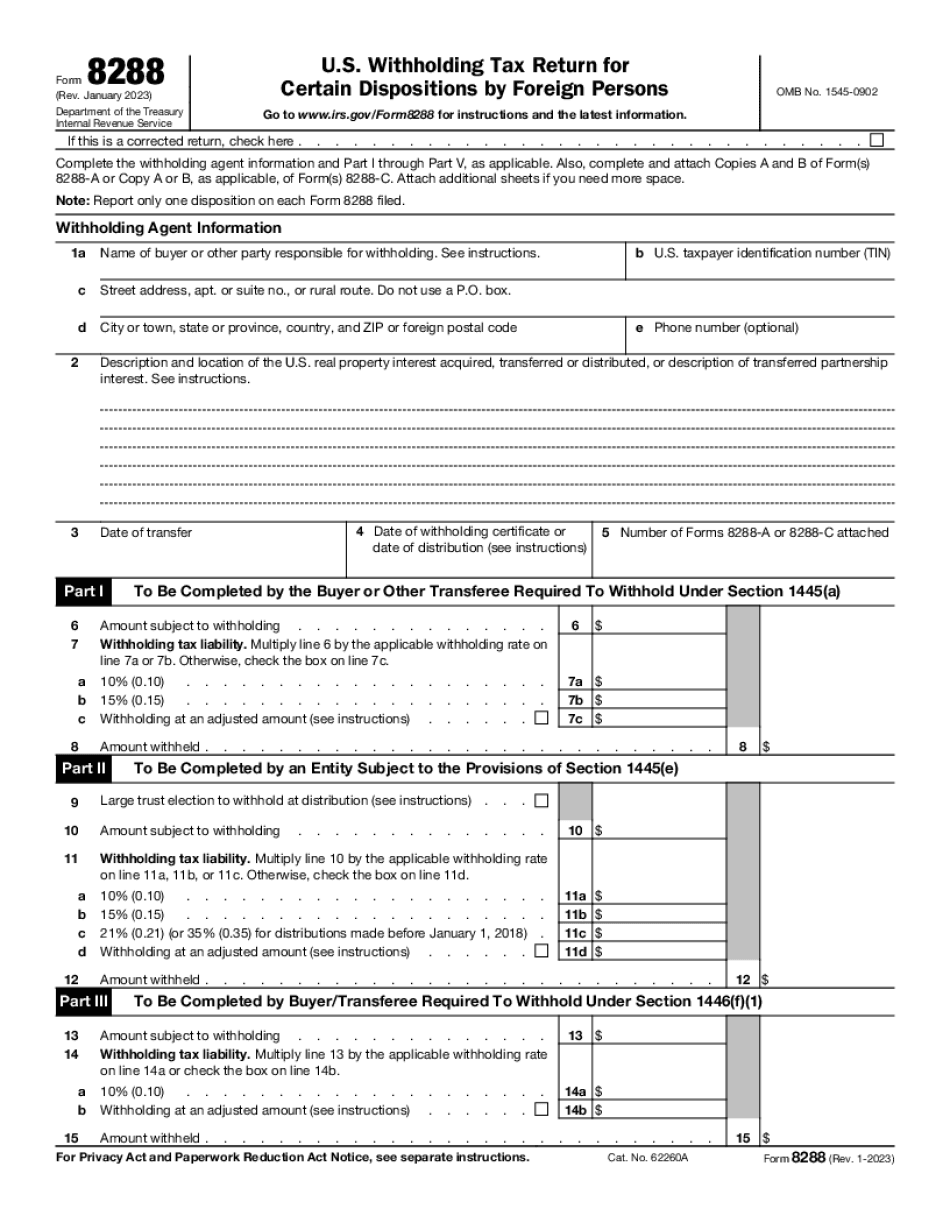

Corporations, “Special Rules for Dispositions by a Fictitious Entity or a Foreign Trust” for the tax year in which the disposition occurred. Related Topic: Tax Filing Issues Related to Foreign Tax Matters in Form 8858 Dec 22, 2025 — There is no requirement for foreign trusts to include or file an information return to the IRS with respect to the transfer of any real property interests. In addition, the information would not be deemed to be furnished or voluntarily disclosed to the IRS.” “In contrast, the Form 8288 requires a written report to be filed if either of the following occurs for a disposition of a real property interest: At least one holder (other than a foreign tax-resident) in a trust owns at least 51% of the total voting power of the corporation or trusts holding the property interests. For the purposes of this section, the 51% ownership threshold for a shareholder includes the holder's right to participate in the election of directors of the corporation.” “The information report will be for each property interest. A joint owner may elect for some of that interest to be made a separate return or to be filed within a separate information return. This election must be made and is not required to be filed.” Transportation of Property Interests; U.S. Withholding Tax on Transportation Income For Form 6166: U.S. Withholding Tax — Reporting Property Interest Transfers — IRS Related Information: IRS Regulations — Reporting Property Interest Transfers Sep 6, 2025 — Foreign individuals must also report the value of transportation income (income generated from the transportation of property interests) by filing Form 6166 with their tax return. For purposes of this part, property interests are those of a personal nature or the property interests of a partnership, S corporation, or an estate. Transportation of foreign property interests subject to U.S. withholding tax: A U.S. reporting requirement — IRS Exemption for Income Tax Withholding on Property Interests and Other Transportation Income Mar 1, 2025 — “Transportation income and other income that does not relate directly to the transport of property interests is exempt from U.S. tax withholding if the income is primarily attributable to the transportation of the property interests. Such income should not be treated as income derived directly from the transportation of property interests. Thus, for the purposes of this paragraph, transportation income or other income should not be considered income from transportation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete North Las Vegas Nevada Form 8288, keep away from glitches and furnish it inside a timely method:

How to complete a North Las Vegas Nevada Form 8288?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your North Las Vegas Nevada Form 8288 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your North Las Vegas Nevada Form 8288 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.