Award-winning PDF software

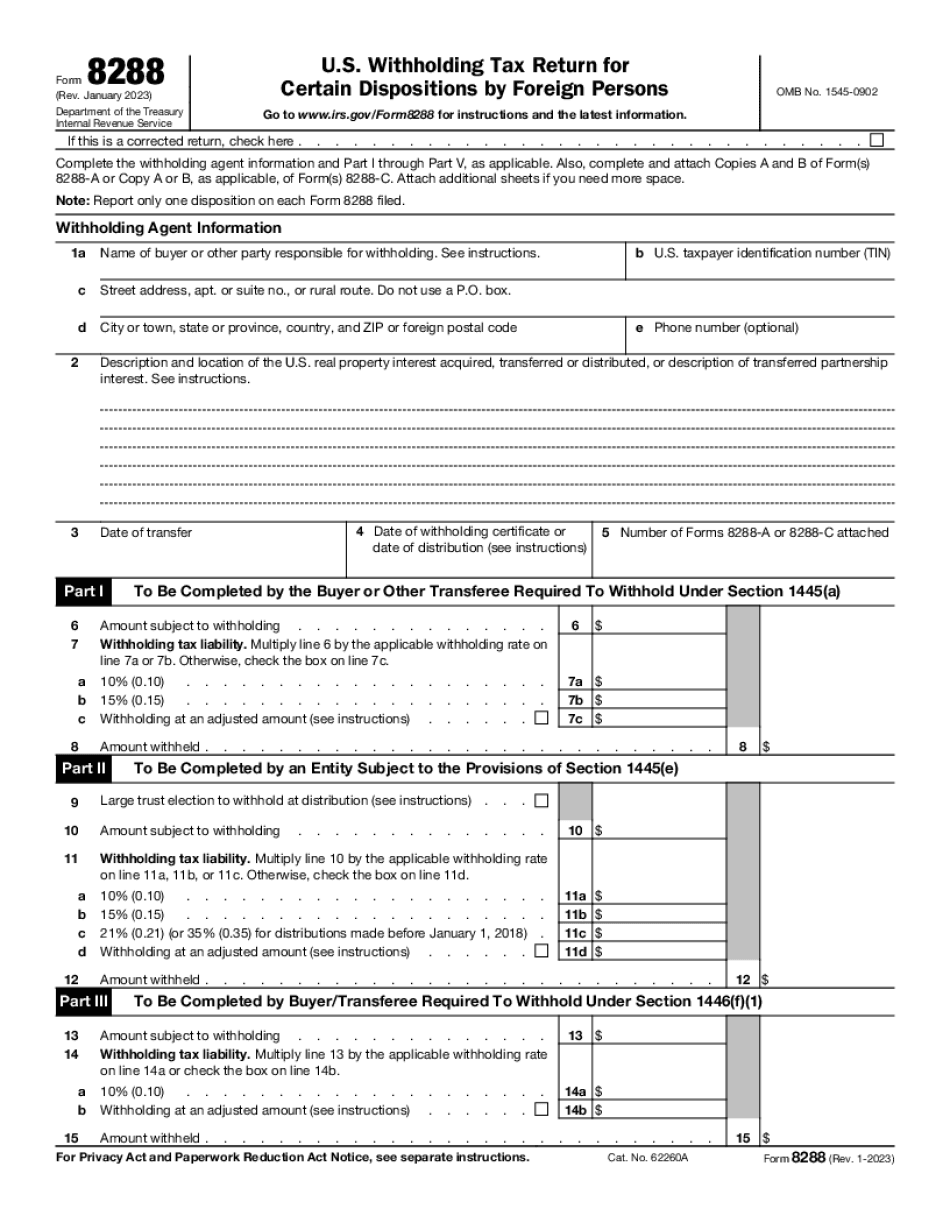

Form 8288 Oklahoma City Oklahoma: What You Should Know

S. Real property of more than 250, 000 — Taxpayers may receive estimated tax benefits for dispositions of property in the United States of foreign persons with U.S. investments of more than 250,000. The rule would not affect ordinary or long-term capital gains and losses in connection with transactions involving foreign persons with U.S. investments of more than 250,000 who hold the property for at least five years. Rules, Procedures, and Enforcement IRS Issues Regulations to Update Foreign Bank Account (FAR) Exceptions to FATWA for Foreign Persons with U.S. Real Property — IRS Releases Final IR–1053R To Clarify Rules for Establishing the Location of Foreign Persons With U.S. Real Property in the United States — IRS announces significant guidance for determining the location of foreign persons that own U.S. real property and how to treat accounts of these foreign persons. The new guidance for FAR is due to go into effect after publication. IRS Issues Regulations for Offshore Holding Companies — Effective in 2018 Inspectors General for the United States—IRS releases regulations for Offshore Holding Companies— Effective in 2018. The regulations, available here, are intended to provide a framework that will ensure that the offshore holding company and the ownership structure of the person who owns the offshore entity is disclosed when an assessment under Section 984 of the Internal Revenue Code (IRC) is filed with respect to a holding company that is not a regulated investment company, as defined in IRC §78.611 ; the disclosure requirement applies even if the offshore entity is not engaged in a trade or business in the United States. IRS Issues Revisions to the Regulations for Offshore Subsidiaries of U.S. Corporations in Response to Implementation of IRC § 78, and in Support of the IRC's Clarification of What a U.S. Offshore Subsidiary Is— Treasury IRS and Treasury Issues Regulations for Offshore Subsidiaries of U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288 Oklahoma City Oklahoma, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8288 Oklahoma City Oklahoma?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288 Oklahoma City Oklahoma aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288 Oklahoma City Oklahoma from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.