Award-winning PDF software

Form 8288 Memphis Tennessee: What You Should Know

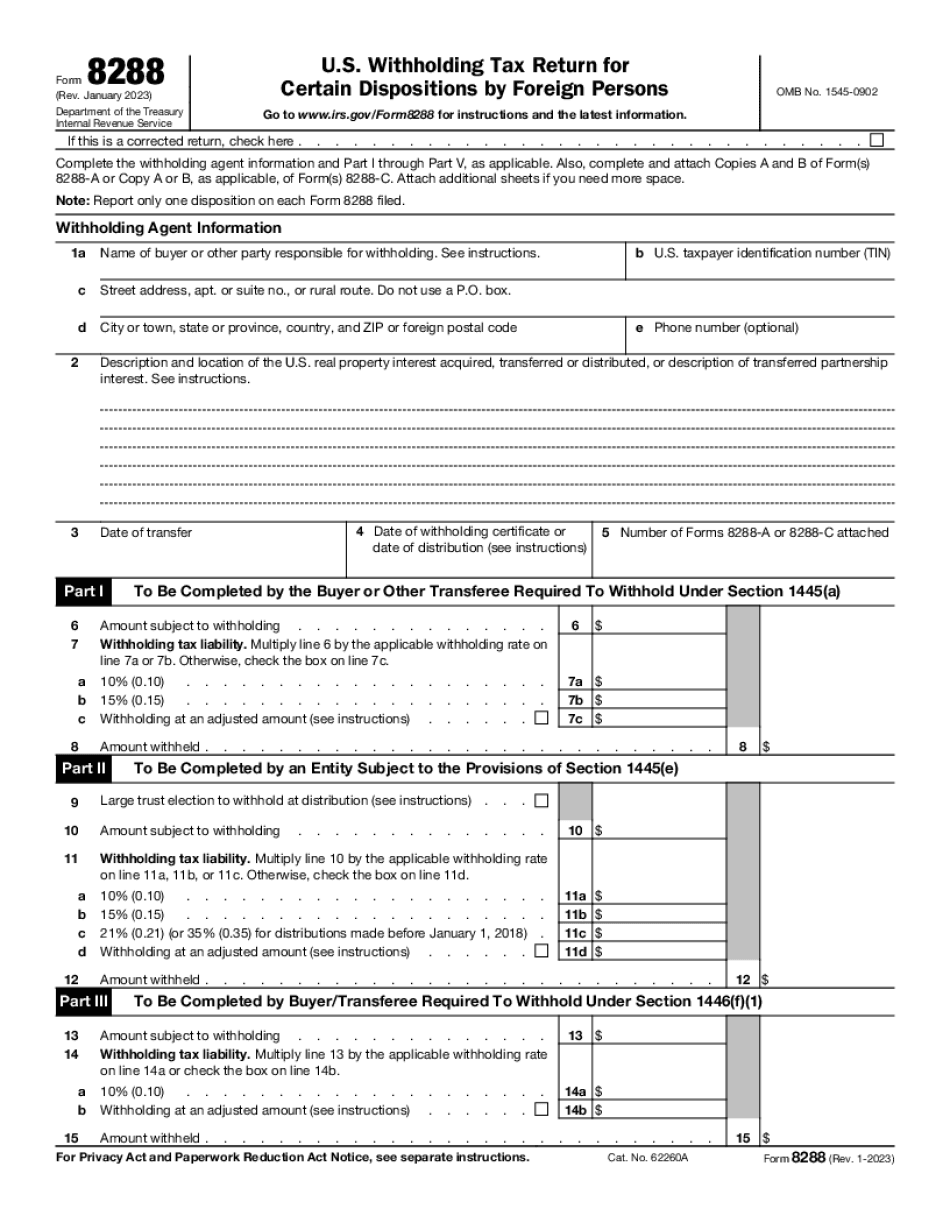

This is a tax professional service organization and does not represent taxpayers or the taxpayers' representatives. For legal advice and services only, call Fine serve Tax Service at 1.800.233.6233 × 6233. This information is not to be considered as legal advice. The IRS is required by law to share tax information in the public domain and on its internet sites. The following material is a general summary without limiting the scope of the information contained in any other website, including the IRS website at. For tax years prior to 2009, the IRS provides two ways for taxpayers to file and receive any Form 540, Summary of Information on Wages And Related Income, To calculate the federal tax, you need to calculate the tax for the entire income year. You can file Form 540 as a stand-alone return. When you file Form 540, the information is sent directly to the IRS for inclusion in the federal income tax. If you file Form 540 to claim a refund, you can claim a portion of your unused standard deduction in the year claimed. If you file your tax return on a calendar year basis and your refund is due in the first month of the following calendar year, you are not required to figure the tax at the end of the year. If you complete another Form 540 with additional information, the information from both Form 540s must be used to figure your tax. For more information or a tax preparer with additional information for your state, check the following: The IRS can mail tax forms electronically. You can also call 800-TAX-FORM). Forms and Instructions Forms and instructions for filing are here. For help on preparing Form 8288, go to U.S. Tax Withholding, Payroll, and Worker's Compensation: Form 8288 and see the following links. If you file your tax return after June 17, 2010, use Form 8288-A-R to report the disposition of all U.S. real property interests in which you are the owner. If you're eligible or wish to claim a deduction, go to Worksheet 2 “Part III” “Adjustment for Capital Gains and Losses on U.S. Real Property Interests Disposed of After June 17, 2010.” Form 8288-A-R provides both the basis and gain or loss for U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 8288 Memphis Tennessee, keep away from glitches and furnish it inside a timely method:

How to complete a Form 8288 Memphis Tennessee?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 8288 Memphis Tennessee aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 8288 Memphis Tennessee from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.