Award-winning PDF software

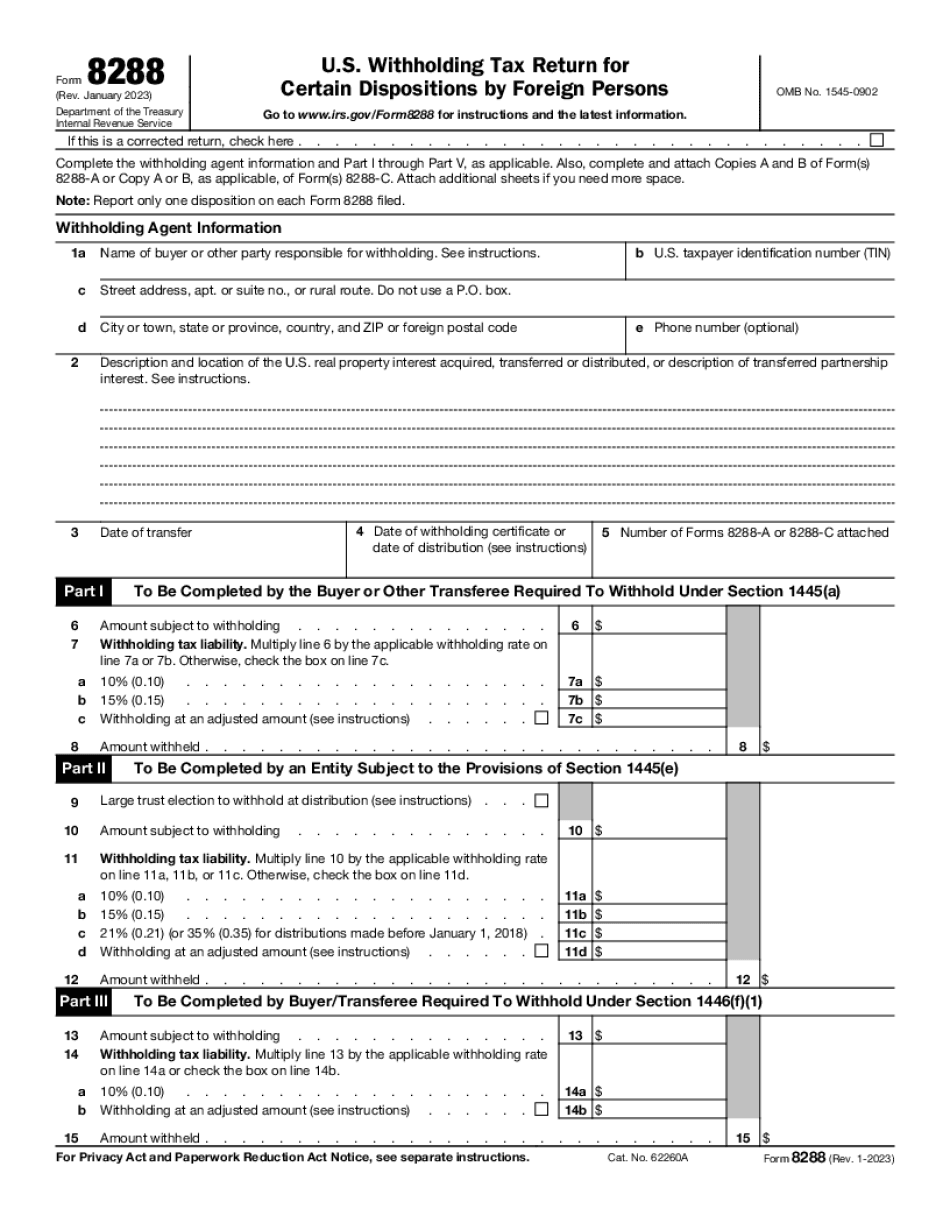

Daly City California online Form 8288: What You Should Know

Use the links below to get more information or speak to an independent tax professional. Contact the IRS on behalf of a taxpayer: Email us at: [email protected] Use the phone numbers in the “How to Call the IRS” section above to get more information on calling the IRS. Use the contact email below to report a problem with the current form. You can also email an issue to [email protected] Informal complaints can also be made to the Federal Trade Commission: Use the FTC's toll-free number 1-877-FTC-HELP or visit its website at: FTC. IRS Tax Protester Assistance Use the following number: Use the following address: [email protected] Tax Protester Resources To download brochures, brochures in different languages, and other tax protester resources, view the following pages: To contact an IRS representative, contact the following number: If you prefer, contact the Office of the Chief Counsel for Taxpayers. The toll-free number also has representatives available to help you. A. A taxpayer can file Form 8288 for a foreign person (whether person or entity) to take custody of real property or share in its income. However, only the Form 8288-B must be filed for this purpose. The foreign person does not need to file a Form 706 for the acquisition of real property by means other than this method. 1. The only time the Form 8288-B is required is if the foreign person acquires property in the United States prior to the filing of the Form 8288-B. Note: This is so the taxpayer can avoid an audit by the foreign person. The IRS advises taxpayers NOT to use this method of taking custody of real property unless you can use this method to mitigate the foreign person's liability for withholding, for example, to claim a depreciation deduction from the value of the property. For more information on how the Form 8288-B affects a foreign person's liability for withholding, see “Form 8288-B: Special Rules for the Disposition of Property in Exportation Transactions.” Further, see “Foreign Re characterization for the Treatment of Property Acquired with a U.S. Real Property Interest.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Daly City California online Form 8288, keep away from glitches and furnish it inside a timely method:

How to complete a Daly City California online Form 8288?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Daly City California online Form 8288 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Daly City California online Form 8288 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.