Hello Anthony, hello Claudine. We are back talking about FATCA. We thought we wrapped up, but one last thing we wanted to talk about. And I would even say that one last thing, yeah, for now, for now, for now. What we want to talk about is we talked about penalties for individuals not filing certain forms, right? For the U.S. persons who have an account, right? That's who we're talking about. Yep, well, we did talk about that, but today we're talking about FFI's or foreign financial institutions. What are the penalties if they don't comply with all the FATCA laws? Right. Lots of digging done, right? We've spent a lot of time because it's like, oh yeah, what is the penalty for them? What did you find out? Not a ton. Okay, so here's what we do know. The foreign financial institutions must report to the IRS information about financial accounts held by US taxpayers or by entities in which US taxpayers hold a substantial ownership interest. They're supposed to undertake certain information due diligence procedures, report annually to the IRS and account holders, and withhold and pay over to the IRS 30 percent of any payments of US source income. But we couldn't, you know, I kept looking for what happens if they don't comply. The only single thing we could find in all our digging is FFI's that do not enter into an agreement with the IRS will be subject to withholding on certain types of payments, including US source interest and dividends, gross proceeds from the disposition of US securities, and pass-through payments. So, I was expecting to find, I mean the IRS is pretty specific about if individuals don't file, certain percentages, certain dollar amounts, certain things are gonna happen. This seems pretty vague...

Award-winning PDF software

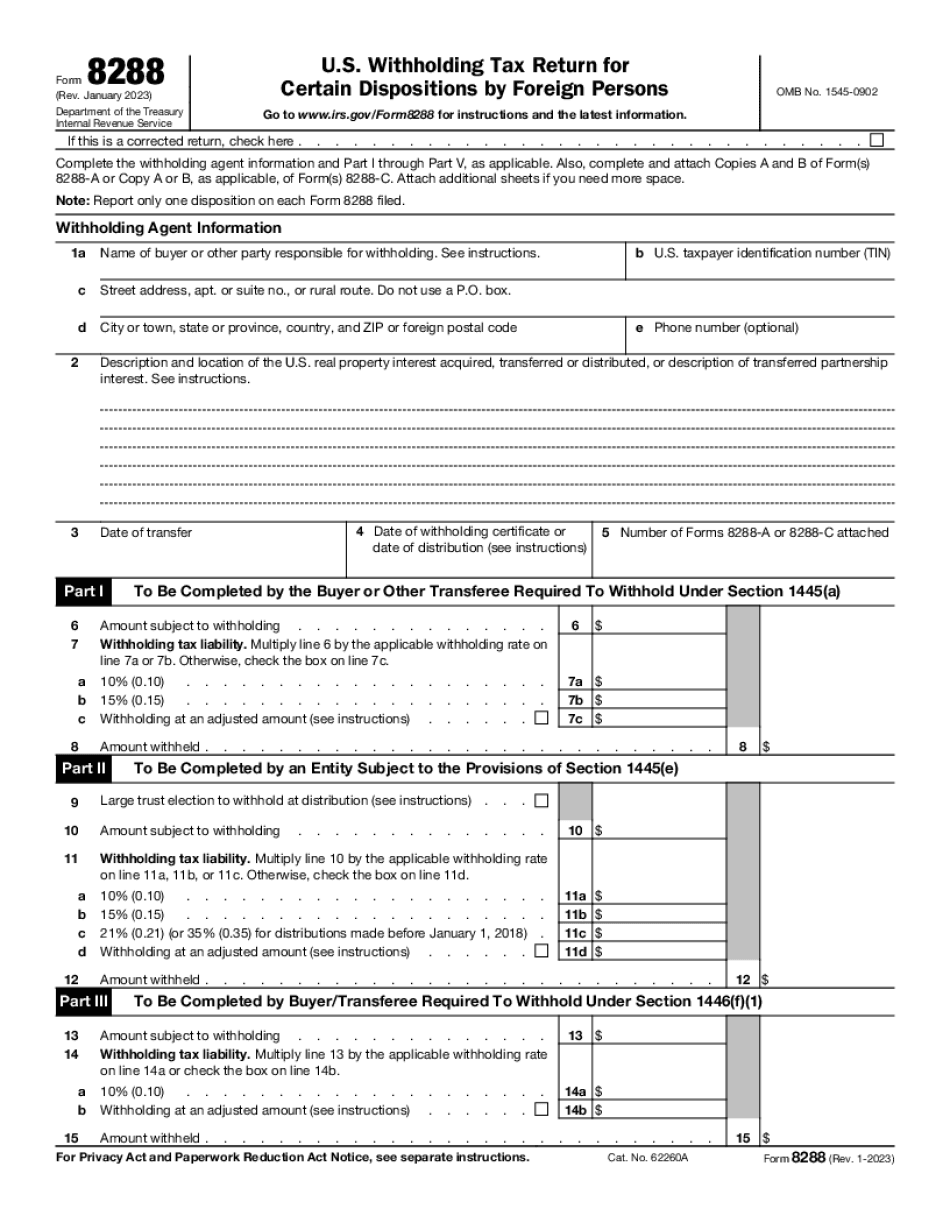

8288 penalties Form: What You Should Know

This will be a continuation of the story of the wife How Did I Get In Trouble With the IRS? I started with a Form 8288 with the Form 8288A, which was signed but was not filed, showing an understated amount of income, due to the non-lodged form. The Tax Advocate Podcast Here's the first clue that my wife wasn't going to have the tax refund that she claimed I got very irritated. This was a new form she requested, and I had no idea about it at first. It took me 2 hours to find and file it for her. She signed the form, and that was it. We weren't sure if it was the actual value of the property she was selling, although the seller's agent had provided receipts for the value of the property I went over to make sure she was satisfied with her purchase, but it didn't add up. How could I do that? But Then, Things Really Got Weird This next letter went out on November 17, 2013, just 10 days after sending the Form 8288 with the Form 8288A. From C Dear Shareholder, The I.R.S. has determined that you are no longer eligible for a refund of taxes paid because it was not filed on time. Please be advised that the property will not be claimed for federal income tax purposes. If you have questions about this matter, call. The next mail came November 19, 2013, Dear Shareholder, The I.R.S. has determined that you are no longer eligible for a refund of taxes paid because it was not filed on time. Be advised that your rights to a refund may be rescinded and that additional civil penalties may apply. If you have questions about this matter, call. I could see how a simple mistake of one form could end with a refund check going from me to the IRS, but I wasn't satisfied by that. So I called the IRS. The agent I had talked to before told me to send the Form 8288 with the Form 8288A to the ICA. That was the I.C.A who would then have to figure out the tax due, and then pay the penalty due. The I.C.A.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8288, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8288 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8288 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8288 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 8288 penalties