Fruta explained that if you own a piece of America as a foreign owner of U.S. real estate and have decided to sell your property, the Foreign Investment in Real Property Tax Act (FERPA) now applies." - "15% of your U.S. property sale price goes to the IRS. But what exactly is FERPA?" - "How can I obtain a tax number?" - "What are the qualifications for an exemption from FERPA?" - "If I made an investment in real property, will I get my money back?" - "FERPA applies when a non-U.S. citizen and non-U.S. resident sells U.S. property." - "The buyer is required to pay the IRS directly, withholding 15% from the foreign seller." - "If the buyer fails to withhold the 15% as required, the IRS will seek payment from the buyer." - "Withholding serves as a prepayment of taxes, awaiting a tax return from the foreign seller." - "If the foreign seller does not have a tax number or social security number, assistance can be provided." - "In some circumstances, an exception to the 15% withholding can be applied for an Individual Taxpayer Identification Number (ITIN)." - "You can review the facts of your sale to determine eligibility and apply for a withholding certificate with an ITIN." - "An ITIN can assist in preparing your U.S. tax return." - "Finally, you may be eligible for a FERPA refund." - "Music.

Award-winning PDF software

Firpta for dummies Form: What You Should Know

June 10, 2025 — FIR PTA is generally not a filing requirement for selling property in the United States, but some foreign buyers of property for resale in this country do file these affidavits. What is the difference between a U.S. federal income tax return and the “FISA” form? You can file a U.S. federal income tax return in either 1040 or 1040A. Form 1040A and Form 1040 are similar. Each form is designed to help the mayor file their federal income tax returns. A Form 1040A and Form 1040 are the only two forms that a non-resident alien mayor may use to file federal income tax return for purposes of withholding, reporting, and paying federal income tax. The U.S. income tax return is intended for individuals who have incomes that are not subject to U.S. income tax. Foreign individuals who do a substantial business in the United States may be subject to the U.S. tax on payments of income that are included on this form. What is the difference between a U.S. federal tax return and filing Form 1040A/1040? The Taxpayer Identification Number (TIN) that is printed on a Form 1040 is different from the TIN that is printed on the form in the U.S. Treasury Department. The TIN used on the Form 1040A is the same in both U.S. federal and state tax return forms. For example, a U.S. federal tax return with the IRS TIN is generally a 1040A. A TIN from a state may be different. For example, a state TIN on a federal tax return is generally a 1040P. Form 1040 with IRS TIN is often called 1040A. What if I don't file my income tax return with this form? You can still file your tax return with IRS TIN, which is the same tax form that is available on IRS.gov and the IRS website. The Form 1040A and 1040 are similar and will help you report and pay your federal and state income tax. Your return and Form 1040A will go into the same drawer in your filing cabinet where you can review and file your tax return with the IRS.

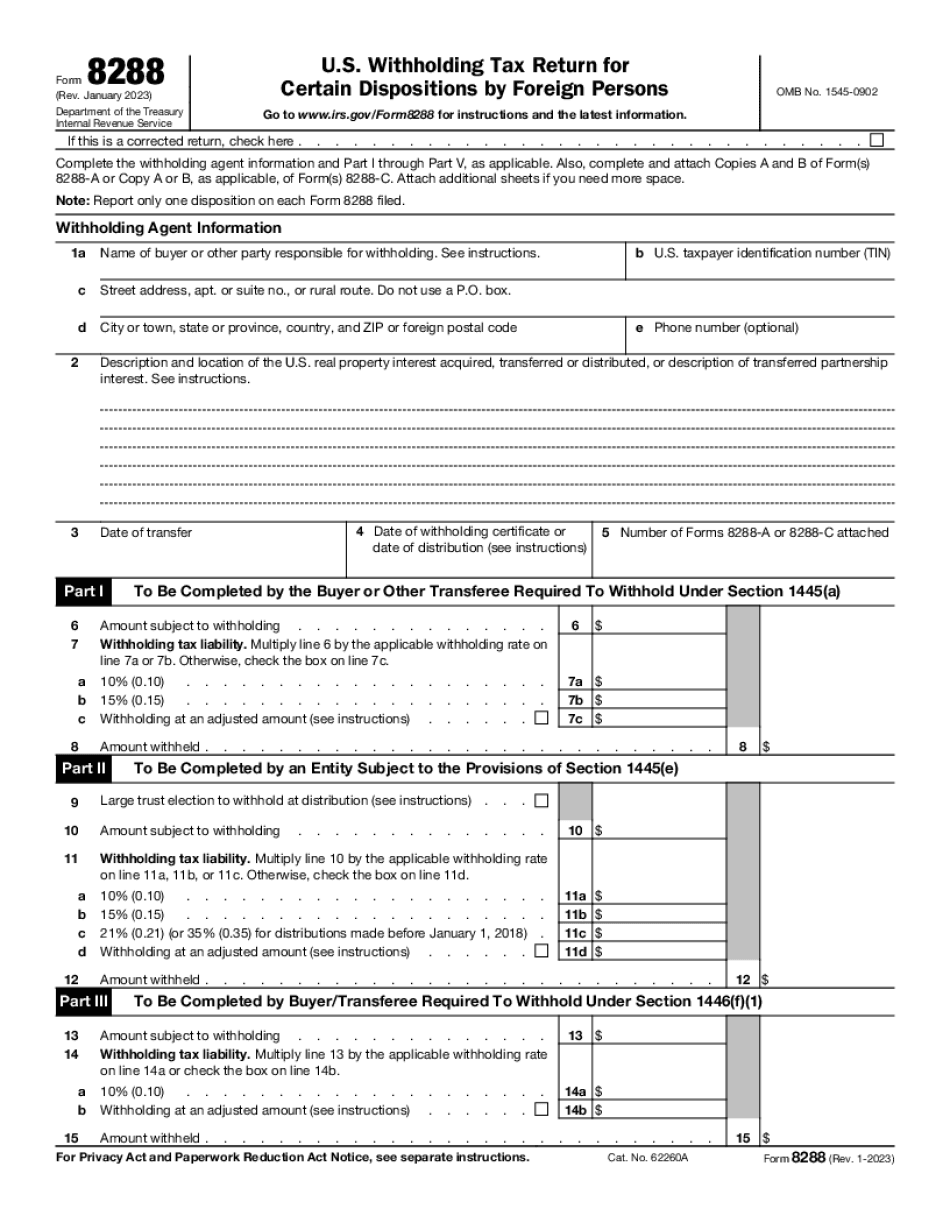

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8288, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8288 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8288 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8288 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Firpta for dummies