Hi, this is John Goodman. Today, we are talking about something called FERPA. FERPA is, of course, an acronym. I'll explain what it means in a minute. But first, let me explain why it is important. FERPA is a federal tax law that could make your buyer responsible for the seller's failure to pay tax on the sale of real property. This might be disappointing to your buyers. So, what we're talking about today is how you can help your buyers decrease the risk that they might be responsible for FERPA-related problems. Here's the concept: it's not unusual for non-US citizens or non-US tax filers to acquire real estate in the United States. It's also not unusual for them to buy property, have it appreciate, and then sell it to make money. However, when a seller sells property and makes money, it doesn't necessarily mean they need to pay taxes immediately. Sellers can defer the gain on the sale of real property by doing things like a 1031 exchange or selling the property through an installment sale (but that's another topic). If the seller does owe money in taxes, Congress and the IRS do not want to have to chase the foreign seller, who may be located in Singapore, Hong Kong, or Saudi Arabia, to collect the tax. That's where FERPA comes in. FERPA, which stands for the Foreign Investment in Real Property Transfer Act, requires a withholding of 15% of the sales price to be escrowed when a non-US tax filer sells property in the US. It's important to note that FERPA is not a tax itself, but rather a tax collection vehicle. The withheld 15% does not necessarily mean that the seller owes that much in taxes. FERPA is designed to force the non-US tax filer to file a...

Award-winning PDF software

Firpta exemption Form: What You Should Know

Filing Form 8828 for non-U.S. Real Property Interests If you want to file an election to avoid income tax by claiming exemptions on foreign real property interests, you must complete and file an application for an exemption certificate. This application should be obtained even if you are buying the property through your own sale (by private treaty or arrangement between a citizen and a foreign country, or through a bona fide sale conducted at a licensed auction) and not through an agency or other person authorized by law to make the sales, or and the property is not in a foreign country. When a purchaser files a request for an exemption certificate pursuant to the Foreign Real Property Interests Holding Certificate (Form 3800), the IRS issues a certificate, that exempts the purchaser from the payment of the nonrecognition tax if the property is foreign real property acquired by means of a cash or negotiable transfer in a non-U.S. jurisdiction or at a transferor's residence, and the proceeds of the disposition are subject to a tax penalty; or If you acquire property in a nontransferable foreign transaction and the nonrecognition tax applies after the disposition, the property is subject to taxation if the real estate is transferred outside a non-U.S. jurisdiction; or All real estate (as defined in section 1221 of the Internal Revenue Code) is subject to taxation by the U.S. for nontaxable purposes and all nonresident aliens are subject to taxation by the IRS if the tax is not limited, limited to income derived or retained, or a tax preference is not provided; or If any portion of the proceeds of a sale of the property would be subject to a nonrecognition tax if the nonrecognition tax applied, there are restrictions on the disposition. You can't claim exemption if you have any of the following conditions: • You paid income tax or a surcharge/finance penalty on the proceeds of a sale by a U.S. person to a non-U.S. person; • A portion of the proceeds of the sale was subject to the withholding tax, or the transferor or transferee did not designate a withholding exemption; • You have a foreign bank account in the U.S.

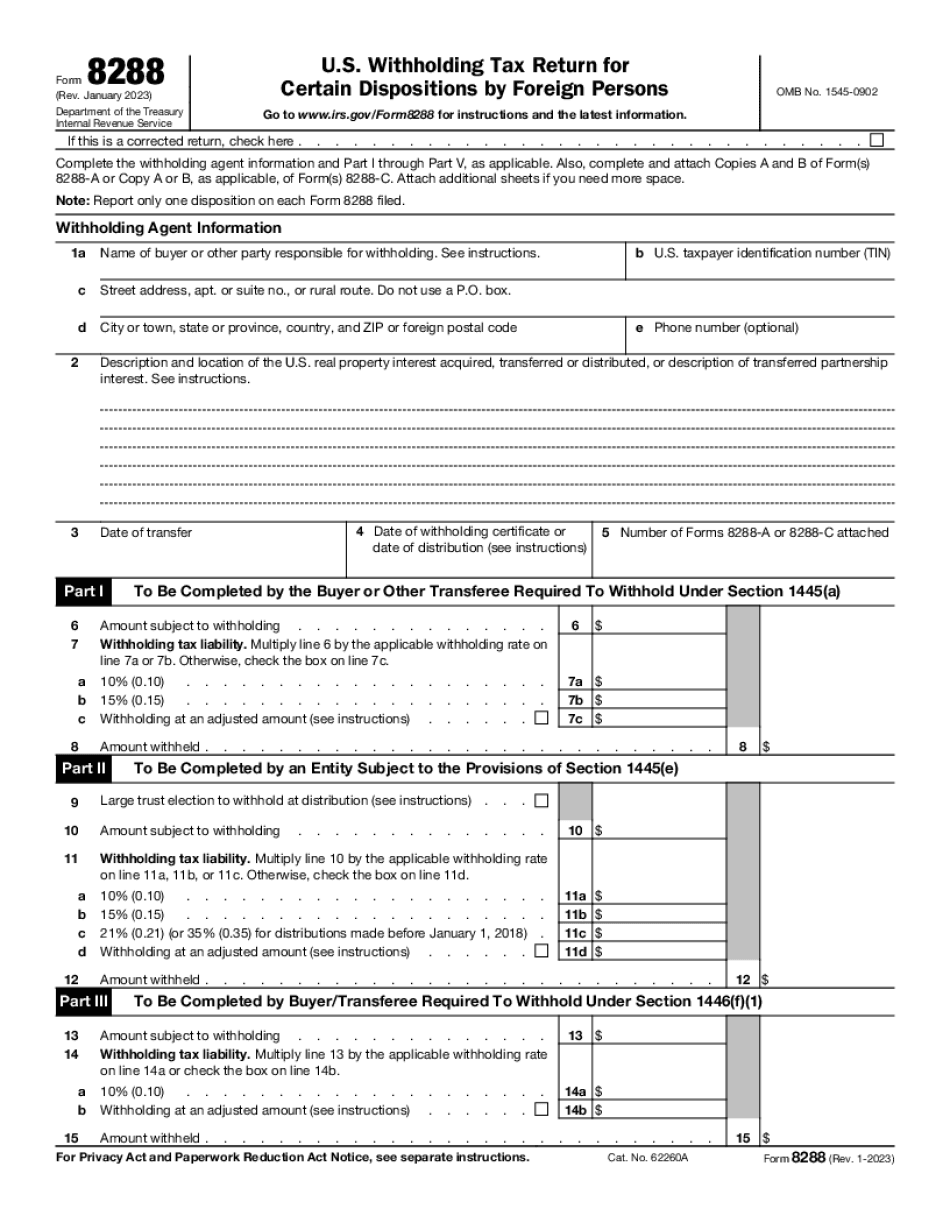

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8288, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8288 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8288 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8288 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Firpta Exemption Form